Recommended

How to Trade Crypto Futures Contracts on BTCC

2024/05/28By:

BTCC is one of the oldest / most established cryptocurrency exchanges, supporting some of the most prominent cryptocurrencies on the market, including Bitcoin, Litecoin, and Ethereum. The exchange has comparatively minimal trading fees for its users.

Trading futures is BTCC’s highlight feature. It stands out for the wide range of futures contracts available, including options for expiry periods (quarterly, annual, etc.) and leverage (up to 225x), allowing users to tailor their trading strategies to their market expectations, investment goals, and risk tolerance.

Unlike spot trading, it allows users to speculate on the future price movements of cryptocurrencies without actually possessing them, as in a crypto wallet. This style of trading allows for both long and short positions, giving you the ability to profit from both market uptrends and downtrends.

Quick Overview

- 1.What is BTCC?

- 2.How to Register an Account on BTCC

- 3.How to Buy and Deposit Crypto on BTCC

- 3.1 Choose fiat currency to deposit

- 3.2 Select Crypto Deposit

- 3.3 Convert

- 4. How to Trade Crypto Futures Contract on BTCC

- 4.1 Choose the type of crypto futures

- 4.2. Choose the type of crypto order

- 4.3. Choose the leverage

- 4.4. Choose the lot size

- 4.5. Set the stop profit and stop loss price

- 4.6. Choose price direction:Buy when bullish, Sell when bearish

- 5. BTCC Pros and Cons

- 6. BTCC Bonus and Promotion

- 7. Is BTCC Safe?

- 8. Conclusion and FAQs

| Download App for Android | Download App for iOS |

1.What is BTCC?

BTCC was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone.

We also have crypto licenses in the United States, Canada, and Europe. Through the ups and downs of numerous market cycles, BTCC has supplied safe trading services with cutting-edge technology for the past 11 years. As the world’s oldest crypto exchange, BTCC has always placed a great emphasis on enhancing every area of trade, seeking to establish a fair trading environment for all crypto enthusiasts worldwide.

The exchange has attracted over 2 million users from around the world as a result of the extensive range of services it provides, which is a direct result of the compliance and trust of its users. The trading of futures contracts on a wide range of cryptocurrencies with up to 225x leverage, as well as spot trading on a few tokens, is the most prominent of these services.

The precise number of cryptos listed fluctuates as BTCC consistently endeavors to update its selection to encompass both established and emergent digital currencies, thereby adapting to the ever-evolving dynamics of the cryptocurrency market.

Additionally, the platform has distinguished itself by its user-friendly interface, which ensures that it is accessible to all, irrespective of their level of cryptocurrency expertise. Its reputation as one of the most widely used and respected cryptocurrency exchange platforms globally has been solidified by its capacity to adapt and innovate rapidly.

2.How to Register an Account on BTCC?

2.1 Open an Account

Creating a new account is the initial stage in beginning to trade on BTCC. To prevent falling victim to phishing attacks, ensure that you visit the official BTCC website and select the “Register” icon located at the top of the page.

This will redirect you to the registration page, where you will be required to submit some basic information, including your email address or phone number and a password. Enter the Referral code below to receive rewards if you have been referred by another BTCC user.

Next, you will receive a confirmation email to validate your identity. Execute the procedure by adhering to the instructions provided in the email. This procedure guarantees that your new BTCC account is exclusively accessible to you.

2.2 Verify Your Identity

In order to comply with KYC/AML regulations, licensed crypto exchanges such as BTCC are required to identify all registered users. To accomplish this, you will require a government-issued identification document, such as a national ID, passport, or driving license.

Not only will your account be verified, but your daily transaction limit will be increased, and you will be eligible for a variety of special offers (coupons/rebates) by uploading a photo of your document(s).

2.3 Secure Your Account

It is imperative to safeguard your account and prevent unauthorized transactions or access once it has been verified. You can simply activate two-factor authentication (2FA) in your account settings, which adds an additional layer of security.

Furthermore, it is crucial to employ a password that is both unique and complex, and it may be beneficial to employ a password manager. It is imperative to safeguard your investments by ensuring the security of your account.

| Download App for Android | Download App for iOS |

3.How to Deposit Crypto on BTCC

After successfully opened an account on BTCC. There are two ways to deposit on BTCC.

- Buy Crypto with Fiat currency ➞ transfer the crypto to your BTCC account

- Deposit crypto from your wallet or other exchanges to your BTCC account

3.1 Choose Fiat Currency to Deposit

Click to operate :https://www.btcc.com/en-US/user-center/assets/deposit/usdt

Deposit in fiat currency is to use credit card or other fiat currency channel to buy and deposit money. As the global fiat currency channel varies, the actual situation needs to be based on the current fiat currency channel used by BTCC to carry out relevant operations.

Select the purchase quantity and payment currency, then click Pay Now on the corresponding payment method to proceed to payment.

After successful purchase, the payment will be credited to your BTCC account within 2~30 minutes. Blockchain network conditions or service provider status may affect the crediting time.

If you encounter any problems when making a deposit, please contact our customer service via the bottom right corner of this page.

3.2 Select Crypto Deposit

Click to Operate :https://www.btcc.com/en-us/user-center/assets/deposit/crypto

Here’s a quick guide on how you can make deposits on our platform.

- Go to the the Assets page on our website. Tap Deposit.

- Select the type of cryptocurrency that you would like to make a deposit in. Tap Deposit to make a deposit of crypto such as USDT/BTC/ETH/XRP.

- If you are depositing USDT, you will see the available networks for this currency, including USDT-OMNI, USDT-ERC20, USDC-TRC20,

- Please choose the deposit network carefully and make sure that the selected network is the same as the network of the platform you are withdrawing funds from. That is to say, if you select the wrong network, you will lose your funds.

- Copy your BTCC Wallet’s deposit address and paste it to the address field on the platform you intend to withdraw crypto from. Alternatively, you may also scan the QR code.

3.3 Convert

BTCC offers futures trading, which enables users to leverage up to 225x on over 300 USDT-margined and coin-margined perpetual contracts. Traders may generate profits by maintaining either long or short positions.

If the user does not possess USDT, it will suggest that they exchange USDT at BTCC. This tool enables users to instantaneously convert over 200 distinct types of cryptocurrencies into USDT, enabling them to trade USDT-margined futures on the platform.

The BTCC Conversion Function is a beneficial addition to the toolkit of a merchant. This enables BTCC consumers to convert the crypto they possess into USDT in a matter of seconds. This eliminates the necessity for users to undergo the time-consuming process of transferring cryptocurrency from their wallet and subsequently converting it to USDT.

You can view specific convert records on the Convert Record.

4.How to Trade Crypto Futures Contract on BTCC

In this guide, we’re taking a closer look at how to buy and sell crypto futures contract on BTCC.

4.1 Choose the type of crypto futures

Here is a list of the many cryptocurrencies available for trading, as well as their market prices. On this page, you may select your cryptocurrency futures contract and monitor the current market price at any moment. You can go long when the price is high and short when the price is low.To see feed of previously executed trades on the platform, select a crypto contract (For example: BTC Weekly).

4.2. Choose the type of crypto order

Select the contract trading order type. BTCC contract orders are divided into market orders, limit orders and stop-loss orders.

- Market Order: Users place orders at the best price in the current market to achieve fast trading.

- Limit Order: Limit Order is used to plunge to the top/bottom of the market, which is a user-defined bid/ask price. Once the market reaches the limit price, it can be filled.

- Stop Loss Order: Stop Loss Order can be interpreted as a “Breakout Order”, which is an advanced limit order where the user can set a custom bid/ask price. After the market reaches the limit price, it will be closed.

The leverage multiplier can be adjusted by yourself, for example, the minimum leverage of BTC contract of the week is 10x, and the high leverage multiplier is 100x.

Trading units can be selected according to the user’s investment situation, the range can be 0.01-30 lots to choose from, with real-time changes in the contract value and reference margin below.

4.3. Choose the leverage

You can manually change your leverage for each position. Choose leverage amount. Specify the amount of leverage by tapping on and tap the leverage amount.

Please keep in mind that operating leverage carries the risk of liquidation. Leverage should be adjusted based on your financial status and risk tolerance.

4.4. Choose the lot size

The contract trading unit at BTCC allow users to choose the number of lots based on their investment situation, and the range can be selected from 0.01 to 200 lots.

4.5. Set the stop profit and stop loss price

Market orders, limit orders and stop orders all need to set a take-profit and stop-loss price. The difference is that market orders are executed immediately at the best price, while limit orders and stop orders need to be set for the same day or a week.

6) Monitor and Manage Trades

After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

| Download App for Android | Download App for iOS |

5. BTCC Pros and Cons

Pros:

Here are the main advantages of using the BTCC cryptocurrency exchange:

- Largest variety of futures: Daily and Perpetual futures

- Flexible leverage from 10x to 150x

- Lowest trading fees 0.03%

- Industry-leading market liquidity

- Plenty of campaigns to win exciting rewards

Cons:

- BTCC is not limited to some of the other cryptocurrency hubs around the world.

.

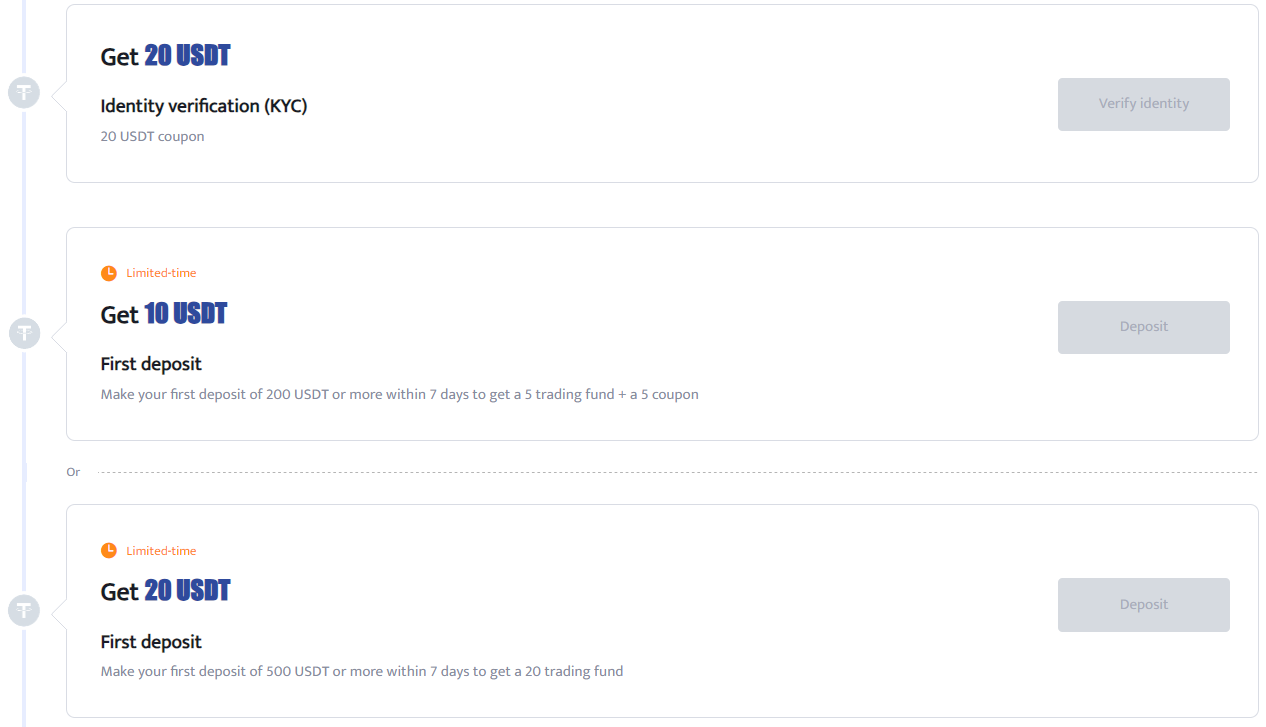

6. BTCC Bonus and Promotion

BTCC holds campaigns from time to time to receive virtual currency bonuses and cashbacks. There are benefits that can only be received when opening a new account, so let’s open an account at this opportunity and get special campaign benefits.

This time, we will introduce the contents of the current campaign one by one. Also, the campaign changes irregularly, so please check the BTCC campaign list for the latest campaign information.

BTCC offers exclusive bonus for new users. Sign up and deposit on BTCC to get up to10,055 USDT in bonuses. Meet the deposit targets within 30 days after successful registration at BTCC, and you can enjoy the bonus of the corresponding target levels.

6.1. 10 USDT bonus for opening an account

This is a campaign where you can receive a “10USDT bonus” when you open a new BTCC account . The only requirement is to open a new BTCC account, so anyone can easily receive a bonus USDT.

In addition, if there is no deposit by the 10th of the following month after opening the account, the bonus will be canceled , so do not forget to deposit.

You will also get an additional 20 USDT coupon on completing your KYC verification.

6.2. Up to 10,055 USDT Exclusive Bonus for New Users

If you deposit a certain amount within 30 days after opening an account, you can get a corresponding bonus.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

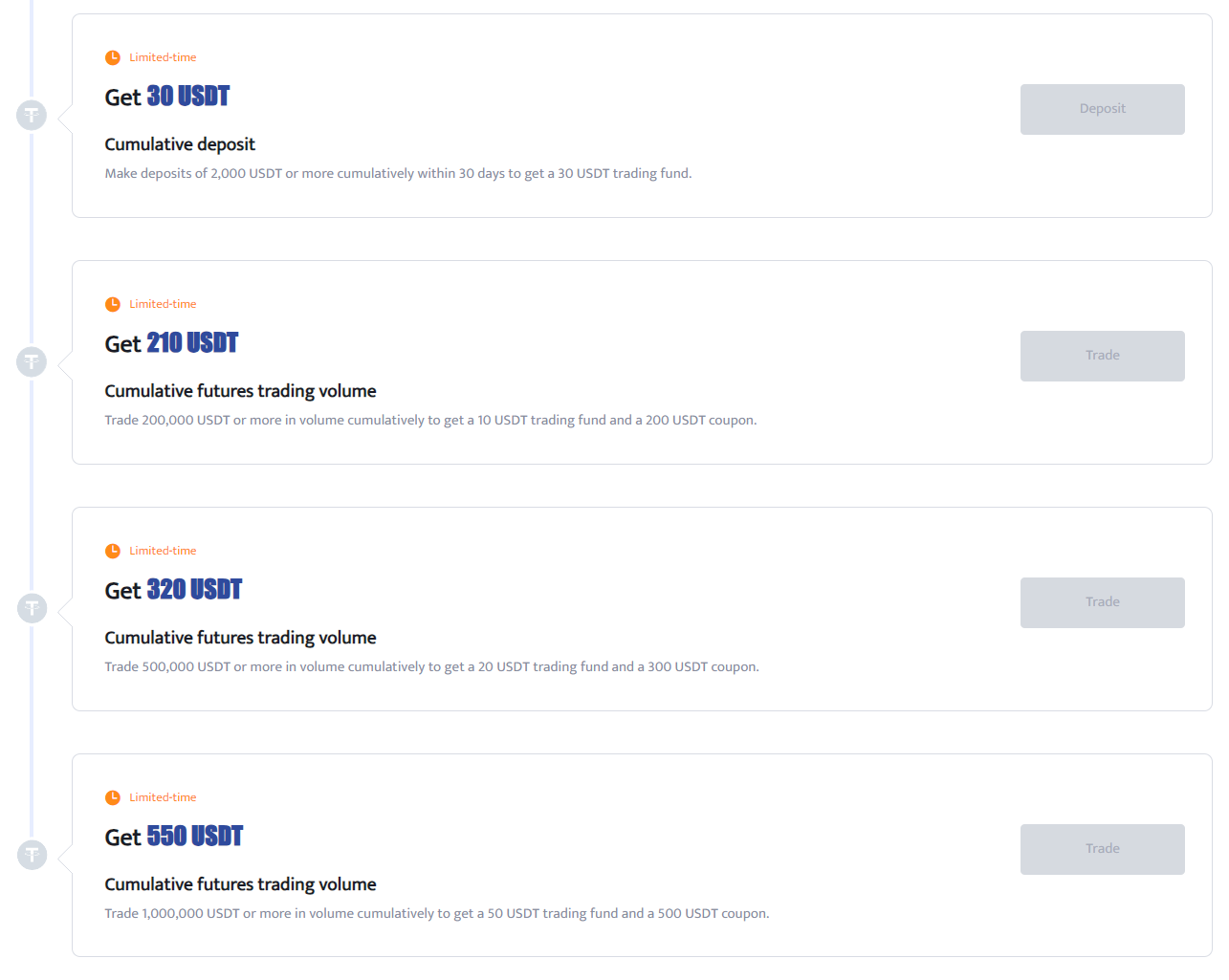

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

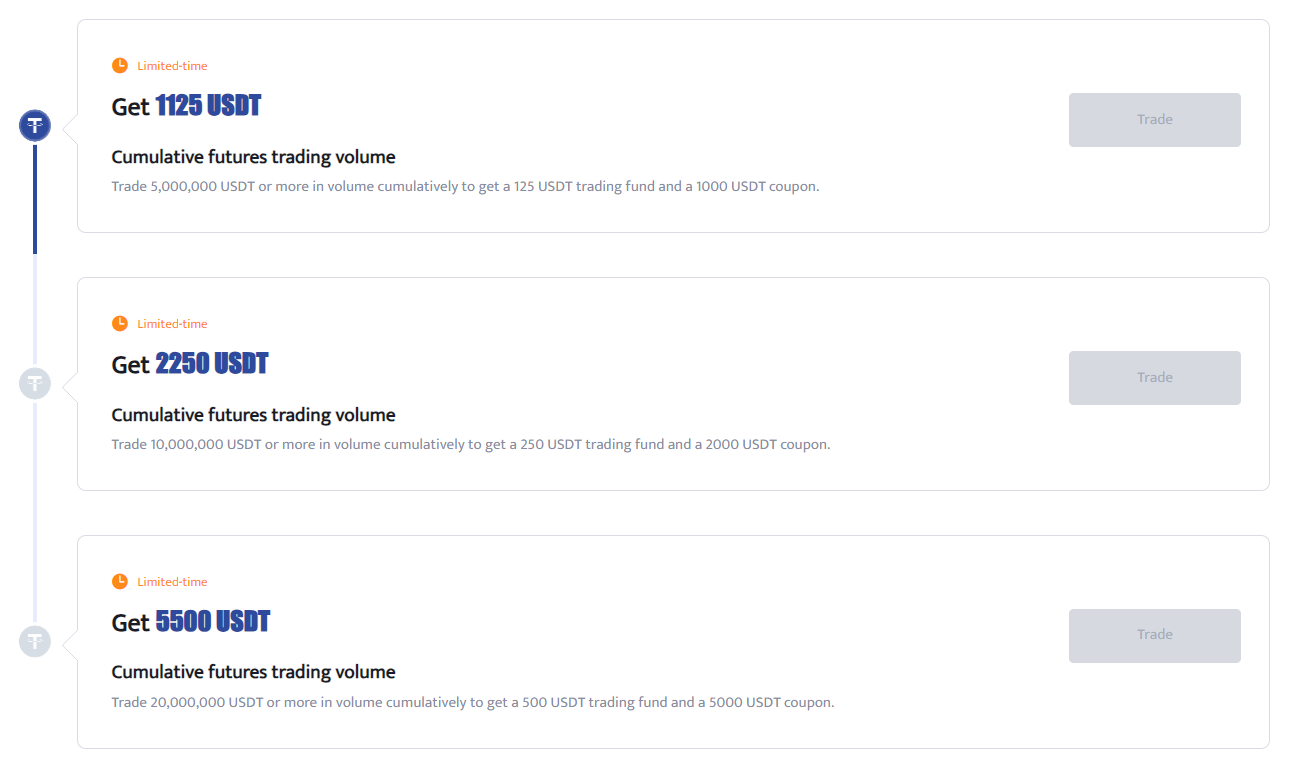

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

6.3 Up to 530USDT bonus by inviting friends

If you Invite a friend to BTCC, you will earn 530USDT . You can Get 25% of your friends’ transaction fees as a reward when they trade. The more friends you invite, the more rebates you’ll get! To refer a new person, the individuals can log into the platform and generate a referral code or a hyperlink that the unique individual can use to navigate to the platform and register.

BTCC also provides many campaigns and you can participate to win exciting rewards.

Find out what campaigns are available now: https://www.btcc.com/en-US/promotions

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

7.Is BTCC Safe?

We reduces the risk of asset loss for its users and creates a safer trading environment for them through the following security measures.

1.Legal and Regulatory Licenses

BTCC has obtained MSB regulatory licenses in the U.S. Canada, Europe respectively.

- Crypto licence issued by the Financial Crimes Enforcement Network (FinCEN) in the USA (license registration number 31000168143239)

- Crypto licence issued by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) (license registration number M20713346).

- Crypto licence issued by the Registrar of Legal Entities of Lithuania (License No. 305950582)

2.Anti-Money Laundering (AML)

The BTCC has also adopted the Anti-Money Laundering (AML) regulation to prevent money laundering and combat the financing of terrorism.

3.KYC Identity Verification

Avoid financial fraud and identity theft.

4.Cold Wallet

BTCC also uses separate cold pockets to store user assets. Although there is no 100% secure storage method, cold pockets have been recognized as a relatively safe method.

5.2FA Dual Authentication

Login with Google/SMS/Email 2FA dual authentication.

To withdraw from BTCC, you also need 2FA dual authentication to add a withdrawal address.

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

8.Conclusion

By adapting to the changing tides of the cryptocurrency market, BTCC has maintained its position as one of the oldest cryptocurrency exchange platforms in the world. Given the company’s track record over the past decade, I would suggest them to anyone who is satisfied with the cryptocurrency and trading pair options they offer and is in a place where they are accessible.

| Download App for Android | Download App for iOS |

Where to Trade Crypto Futures?

Now you can trade Bitcoin (BTC) futures on BTCC. BTCC, a cryptocurrency exchange , was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. BTCC is a crypto exchange offering users liquid and low-fee futures trading of both cryptocurrencies and tokenized traditional financial instruments like stocks and commodities.

BTCC offers exclusive bonus for new users. Sign up and deposit on BTCC to get up to 10,055 USDT in bonuses. Meet the deposit targets within 30 days after successful registration at BTCC, and you can enjoy the bonus of the corresponding target levels. Find out what campaigns are available now: https://www.btcc.com/en-US/promotions

iOS QR Code Android QR Code

Why Trade Crypto Futures on BTCC?

To trade Crypto futures, you can choose BTCC crypto exchange.BTCC, a cryptocurrency exchange situated in Europe, was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone. Over 11 years of providing crypto futures trading services. 0 security incidents. Market-leading liquidity.

Traders may opt to trade on BTCC for a variety of reasons

- Secure:safe and secure operating history of 11 years. Safeguarding users’ assets with multi-risk management through the ups and downs of many market cycles

- Top Liquidity:With BTCC’s market-leading liquidity, users can place orders of any amount—whether it’s as small as 0.01 BTC or as large as 50 BTC—instantly on our platform.

- Innovative:Trade a wide variety of derivative products including perpetual futures and tokenized USDT-margined stocks and commodities futures, which are innovative products invented by BTCC.

- Flexible:Select your desired leverage from 1x to 150x. Go long or short on your favourite products with the leverage you want.

- Mobile App

-

- 1. Download the BTCC App via App Store or Google Play

- 2. Register and verify your account, or log in to your BTCC account.

- 3. Tap ‘Buy Crypto’.

- *Please note that only verified users are eligible to buy crypto on BTCC.

- 4. Enter the amount you would like to buy in USDT.

- 5. Select a service provider and proceed to payment.

BTCC FAQs

1.Is BTCC safe?

Since its inception in 2011, BTCC has made it a priority to create a secure space for all of its visitors. Measures consist of things like a robust verification process, two-factor authentication, etc. It is considered one of the most secure markets to buy and sell cryptocurrencies and other digital assets.

2.Is it possible for me to invest in BTCC?

Users are encouraged to check if the exchange delivers to their area. Investors in BTCC must be able to deal in US dollars.

3.Can I Trade BTCC in the U.S?

Yes, US-based investors can begin trading on BTCC and access the thriving crypto asset secondary market to buy, sell, and trade cryptocurrencies.

Related Posts:

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*