Recommended

5 Best Crypto Leverage Trading Platforms in 2024

2024/04/17By:

If you have limited capital but wish to trade cryptocurrencies, leverage may be the answer. Although potentially hazardous, the increased access to capital will enable you to magnify profitable transactions.

This article analyzes the nine top platforms for crypto leverage trading in 2024. In addition to safety, leverage limits, fees, and commissions are also examined in our evaluations.

Best Leverage Trading Platforms

Now let’s go into our in-depth analyses of the top platforms that provide leveraged cryptocurrency trading.

| Download App for Android | Download App for iOS |

1.BTCC

BTCC is one of the oldest / most established cryptocurrency exchanges, supporting some of the most prominent cryptocurrencies on the market, including Bitcoin, Litecoin, and Ethereum. The exchange has comparatively minimal trading fees for its users.

The exchange has seen 3+1 Bitcoin halvings and boasts a perfect 13-year streak without any security issues.BTCC has been in operation for more than a decade, serving over 2 million people and adding new members every year.

BTCC offers futures trading, allowing customers to leverage up to 225 times on over 300 USDT-margined and coin-margined perpetual contracts. Traders might earn from holding either short or long holdings.

If the user does not have USDT, it will offer to trade it at BTCC. This application allows users to rapidly convert over 200 different cryptocurrencies into USDT and trade USDT-margined futures on the platform.

The BTCC Conversion Function is a great addition to any trader’s toolkit. This allows BTCC clients to change their cryptocurrency into USDT in seconds. This eliminates the need for users to go through the time-consuming procedure of transferring cryptocurrency out of their wallet and then converting it to USDT.

Pros

- The exchange offers one of the most diverse ranges of futures, including daily, weekly, quarterly, and perpetual futures.

- Flexible leverage is available from 10x to 150x.

- BTCC offers one of the industry’s lowest trading fees at 0.03%.

- The copy trading feature is accessible, which allows for even more profits.

Cons

- The exchange is more centralized than its contemporaries.

- BTCC offers fewer fiat deposit choices than other exchanges.

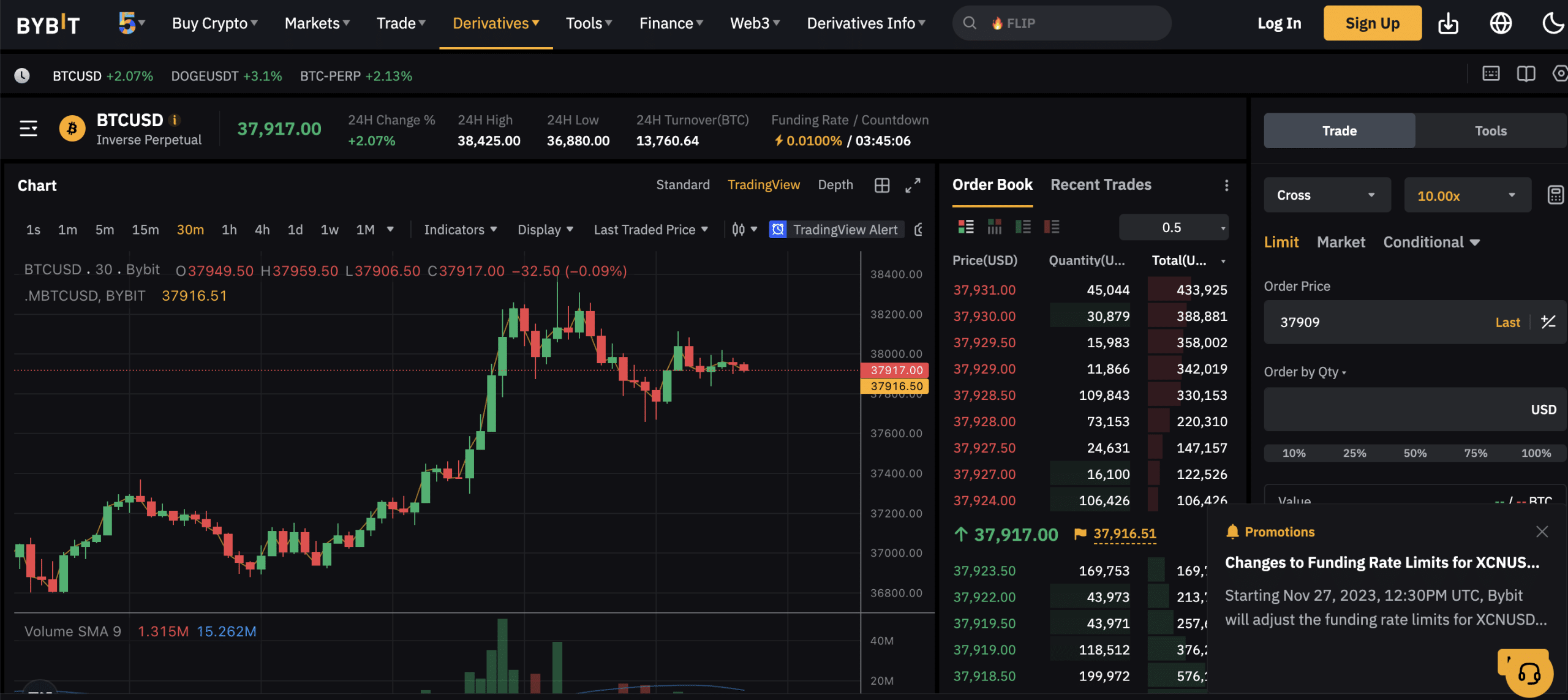

2.Bybit

In the realm of cryptocurrency leverage trading, Bybit is another option to think about. In the last day, users of Bybit exchanged cryptocurrency valued at over $2 million. As a result, you’ll have access to substantial amounts of liquidity. Plus, there is a vast selection of leveraged items available from Bybit. Included in this category are perpetual futures; Bitcoin’s maximum leverage is 125x.

Ethereum, Dogecoin, Solana, and XRP are among the supported cryptocurrencies. On the other hand, the leverage limitations for cryptocurrencies are smaller. Traditional cryptocurrency futures are also available on Bybit, albeit they currently only work with Bitcoin and Ethereum. The contract’s expiration date can be anywhere from 2023 to 2024.

When it comes to crypto leverage trading platforms, Bybit is among the top options for ‘inverse’ contracts. These function similarly to futures contracts, however instead of USDT, the underlying cryptocurrency is used for settlement and margining. Futures commissions begin at 0.055% and options commissions at 0.02%. The spot trading fees offered by Bybit are competitive as well; market takers pay a little 0.1% each slide.

Pros

- 125x leverage is available on perpetual Bitcoin futures.

- Accommodates both long and short positions

- Furthermore backs conventional futures and options

- The underlying cryptocurrency is used to settle and margin inverse contracts.

Cons

- Slightly more expensive trading fees for futures than other platforms

- The regulatory status is still unclear.

| Download App for Android | Download App for iOS |

3.Binance

When it comes to cryptocurrency leverage trading platforms, Binance is among the top. More than 600 different cryptocurrencies are compatible, and they all have leverage features. When it comes to this, you have a couple of options. To start, the vast majority of traders will bet on futures that never expire. Leverage on Bitcoin futures is up to 125x on Binance, while other cryptocurrencies have lower leverage.

In contrast to Uniswap, where you can expect a maximum of 20x, Ethereum offers up to 100x. Leveraged options are the second option available on Binance. A little sum called the “premium” is required to purchase these in advance. Also, according on your strategy, you can choose a strike rate and an expiration date.

Your monthly trading volume and the leveraged product you choose will determine the fees. One example is the possibility of trading futures for as little as 0.05% each slide. Options begin at a remarkably low 0.03%. Binance provides access to spot trading marketplaces in addition to its leveraged products. Our commissions begin at 0.01%.

Pros

- The largest cryptocurrency exchange in the world offers premium liquidity.

- More than 600 leveraged marketplaces are supported

- Leverage can be obtained through options or futures

- Extremely cheap commissions for trading

- There is live chat help accessible. All the time.

Cons

- Recently, Binance was fined over $4 billion for violating laws against money laundering.

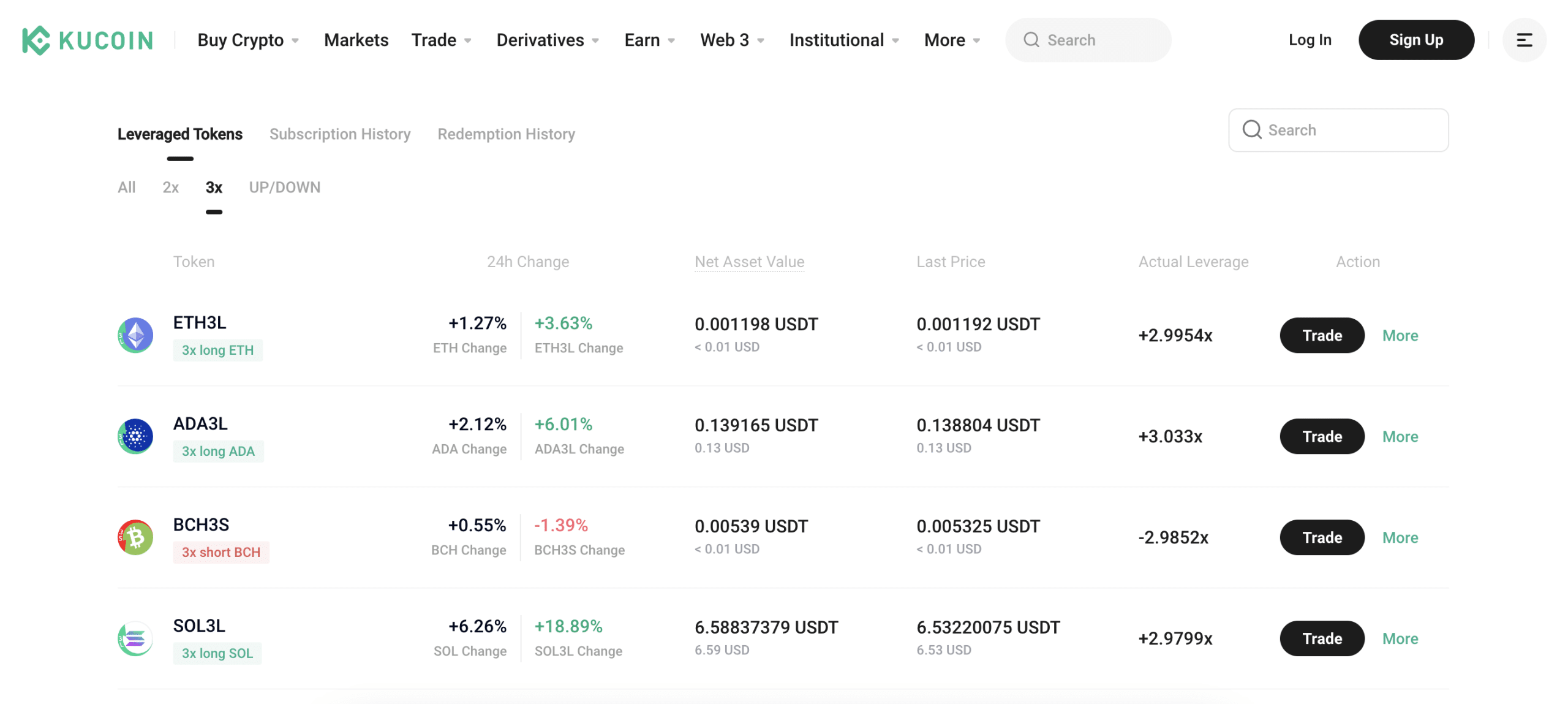

4.KuCoin

If you’re a trader worried about liquidation, KuCoin is for you. Without the need for loans, it provides leveraged token markets. On the contrary, KuCoin generates its own markets. Bitcoin, Ethereum, Bitcoin Cash, Arbitrum, and Solana are among the most widely used cryptocurrencies that can be traded. There is a long and short market for every coin that is supported.

Two- or three-fold leverage is at your disposal, depending on the coin in question. Depending on the number of long and short traders, you will receive somewhat more or less than the specified leverage amount. Consider the current leverage offer of 2.992x in the long Ethereum 3x market. Crypto futures are another feature that KuCoin offers with leveraged tokens.

Markets settled in USDT and USDC are covered by more than 245 distinct contracts. To settle your position in the underlying cryptocurrency, you can also use the inverse contracts that are available. With KuCoin, you can have a maximum leverage of 100x. Discounts are available for traders who engage in higher volume transactions, although the starting leverage fee for market takers is 0.06%.

Pros

- Gain three times the leverage without taking out loans or liquidations

- 100x leveraged perpetual and inverse futures

- Derivative trades of $1.3 billion were completed in the previous day.

- Numerous sophisticated trading instruments, such as technical indicators

Cons

- Commissions are higher than those of other suppliers, at 0.06%.

- KYC procedures that are mandatory for all new users

| Download App for Android | Download App for iOS |

5.Kraken

If you’re a short-term trader, you might be interested in Kraken’s traditional margin accounts. A leverage of 5x is possible with a minimal margin requirement of only 20%. Ethereum, Bitcoin, Dash, Cardano, Solana, Arbitrum, and Dogecoin are among the over a hundred cryptocurrencies that are compatible. Limit and market orders are both supported by margin accounts.

Furthermore, short-selling is also legal, allowing you to bet on a decline in bitcoin prices. One major issue with Kraken is the exorbitant leverage costs. A fee of 0.02% of the trade value will be paid every four hours for each open margin position. To top it all off, opening and closing leveraged positions will cost you a commission.

From 0.01% to 0.02% is the range that applies to several cryptocurrencies. Moreover, leveraged futures markets are available on Kraken. There is a maximum leverage restriction of 50x and 95 different coins are compatible. Futures also have cheaper costs; the total amount you’ll pay is only 0.05% of your position amount. Rollover fees are not applicable, unlike margin accounts. This is crucial.

How to Choose Best Leverage Crypto Exchange?

For those who decide to proceed, the next step will be to choose the best cryptocurrency exchange with leverage. This is not always an easy process, as there are many online cryptocurrency exchanges that offer leveraged operations.

Choosing to trade with the cryptocurrency exchange with the highest leverage is not always the best choice, so some important factors must be considered when choosing a cryptocurrency exchange that also offers margin trading.

The various exchanges available often offer different levels of leverage, with some margin exchanges offering traders up to 100x leverage. The interest rate offered by a leveraged trade is an additional consideration, and depending on the duration of your position and the leverage, you could end up paying a fairly high rate.

Some cryptocurrency exchanges offer variable rates, including one or two major exchanges in the region, at 3.60% APR and 0.01% daily, which is a good rate for short-term positions.

1.Can U.S. traders use the BTCC exchange?

Of course, BTCC accepts US traders on its platform. They can sell, purchase, or trade bitcoins in the excess marketplace using the BTCC exchange. And, of course, any USD deposits must be KYC-verified first.

2.What can you trade on the BTCC?

BTCC allows users to trade over 300 crypto futures, including USDT-margined and coin-margined options. Traders can use up to 225x leverage to enhance their trades. Furthermore, the site provides handy choices for both cryptocurrency and fiat deposits.

3.Is BTCC the ideal exchange for you?

If Bitcoin trading is your top priority, BTCC is definitely the finest exchange for you. This company has been focused on Bitcoin since 2011 and provides a user-friendly platform for all types of traders, both experienced and new.

4.Is the BTCC Exchange trustworthy?

BTCC has a 13-year track record of secure operations, with zero security problems. Along with this, it has adopted current security measures, making it a safer and more trustworthy environment than its contemporaries.

How to Trade Crypto Futures on BTCC?

To trade with BTCC, please follow these general steps:

Register an account: Visit the BTCC website and create an account. Provide the requested information, complete the verification procedure, and implement any necessary security measures, such as two-factor authentication (2FA).

Deposit Funds: After you’ve created your BTCC account, you’ll need to fund it. BTCC may accept numerous deposit methods, including bank transfers, cryptocurrency deposits, and other payment choices. Select the way that works best for you and follow the instructions to deposit funds into your account.

Choose a Trading Pair: BTCC offers a variety of cryptocurrency trading pairings. Choose which trading pair you want to trade. For example, if you wish to exchange Bitcoin for Ethereum, use the BTC/ETH trading pair.

Place an Order: BTCC normally offers choices for market and limit orders. A market order allows you to buy or sell cryptocurrencies at the current market price. With a limit order, you specify the price at which you wish to purchase or sell, and the trade is executed when the market hits that price.

Monitor and Manage Trades: After placing your order, you can track the status of your trade using the BTCC interface. You may see open orders, filled orders, and your trading history. You can also use stop-loss or take-profit orders to limit your risk or automate specific components of your trading plan.

Withdraw Funds: If you want to take your funds off the exchange, you can do so by withdrawing them from your BTCC account. To initiate a withdrawal, follow the instructions provided and provide the relevant information, such as the destination wallet address.

Stay Informed: Keep track of market movements, news, and other variables that may affect cryptocurrency values. BTCC may offer real-time market data, trading charts, and analysis tools to assist you make informed trading decisions. Staying educated can help you optimize your trading tactics.

Look more:

How to Trade Crypto Futures Contracts on BTCC

How to Buy and Deposit Crypto on BTCC?

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

About BTCC

BTCC is one of the world’s oldest and most popular bitcoin exchanges. Bobby Lee created it in 2011, with its headquarters initially located in Shanghai, China. BTCC contributed significantly to the early development of the Bitcoin and cryptocurrency ecosystems.

BTCC initially concentrated on Bitcoin trading, but it gradually expanded its capabilities to cover other cryptocurrencies as well. The exchange allows users to purchase, sell, and trade numerous cryptocurrencies, including as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), among others.

BTCC has received recognition for its strong trading platform, liquidity, and security precautions. The exchange provides features such as spot trading, margin trading, and futures trading to accommodate various types of traders and investors. It gives consumers real-time access to market data, order books, and trading charts, allowing them to make informed trading decisions.

BTCC has undergone various alterations throughout the years in order to adapt to the changing regulatory landscape. It expanded its activities abroad, opening offices in other countries to serve a global customer base. However, cryptocurrency legislation and availability may differ based on jurisdiction.

As the cryptocurrency market evolves, BTCC remains a significant player in the industry, providing a variety of services and contributing to the growth and development of the crypto ecosystem.

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

| Download App for Android | Download App for iOS |

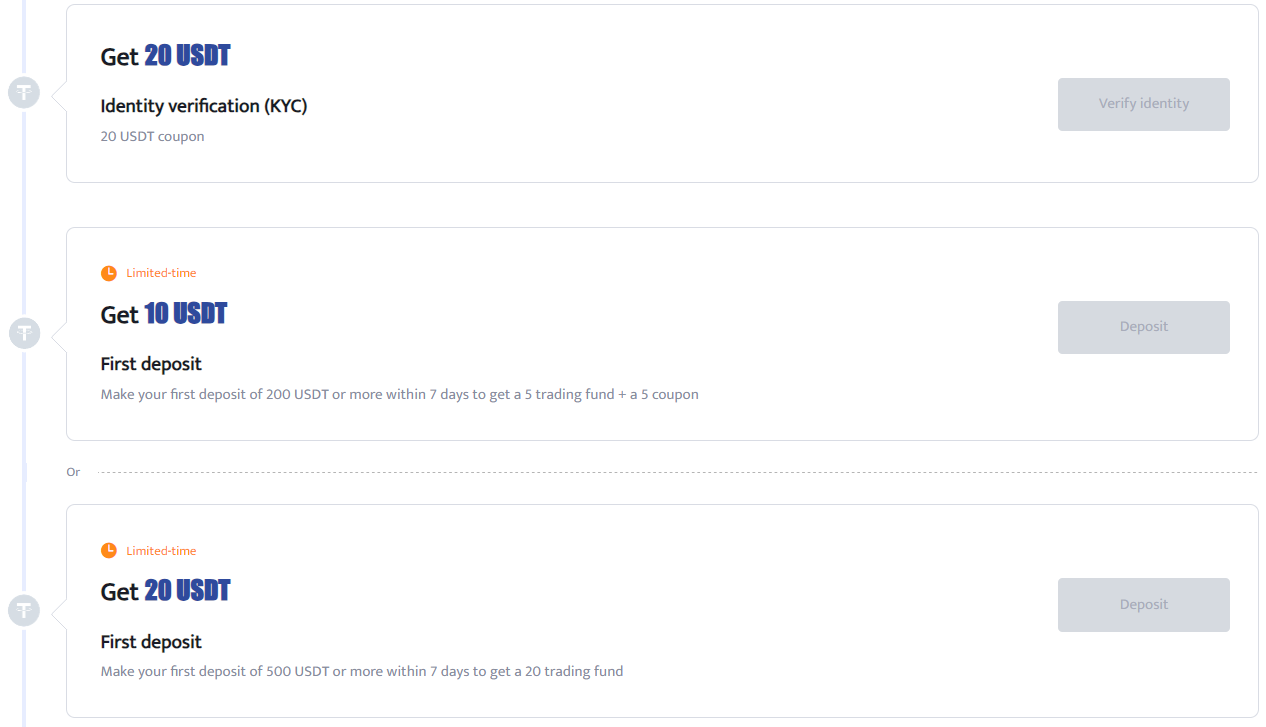

BTCC Bonus

BTCC bonuses apply to different categories of users. You can deposit and receive up to 10,055 USDT. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

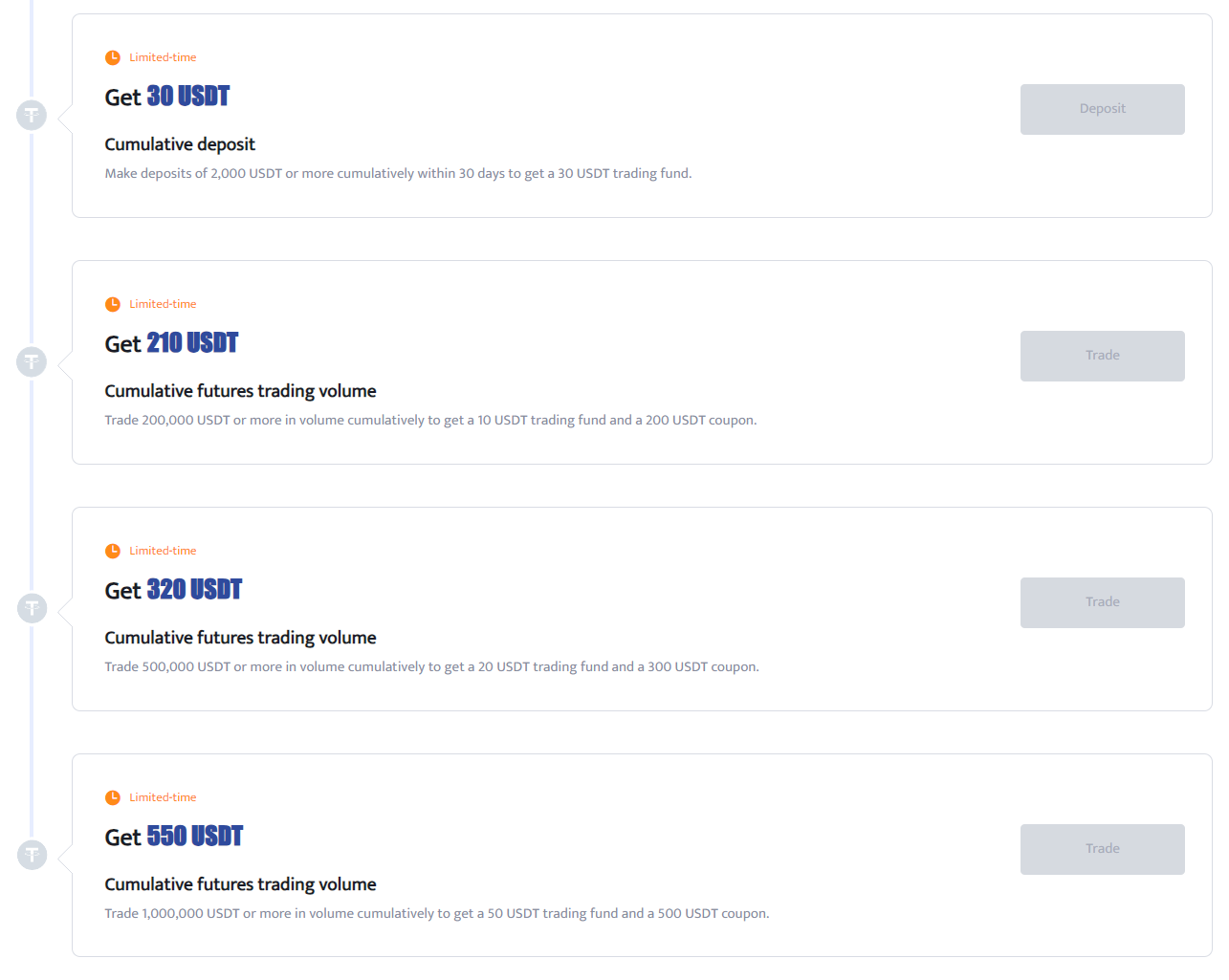

- BTCC Futures Trading Bonus

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

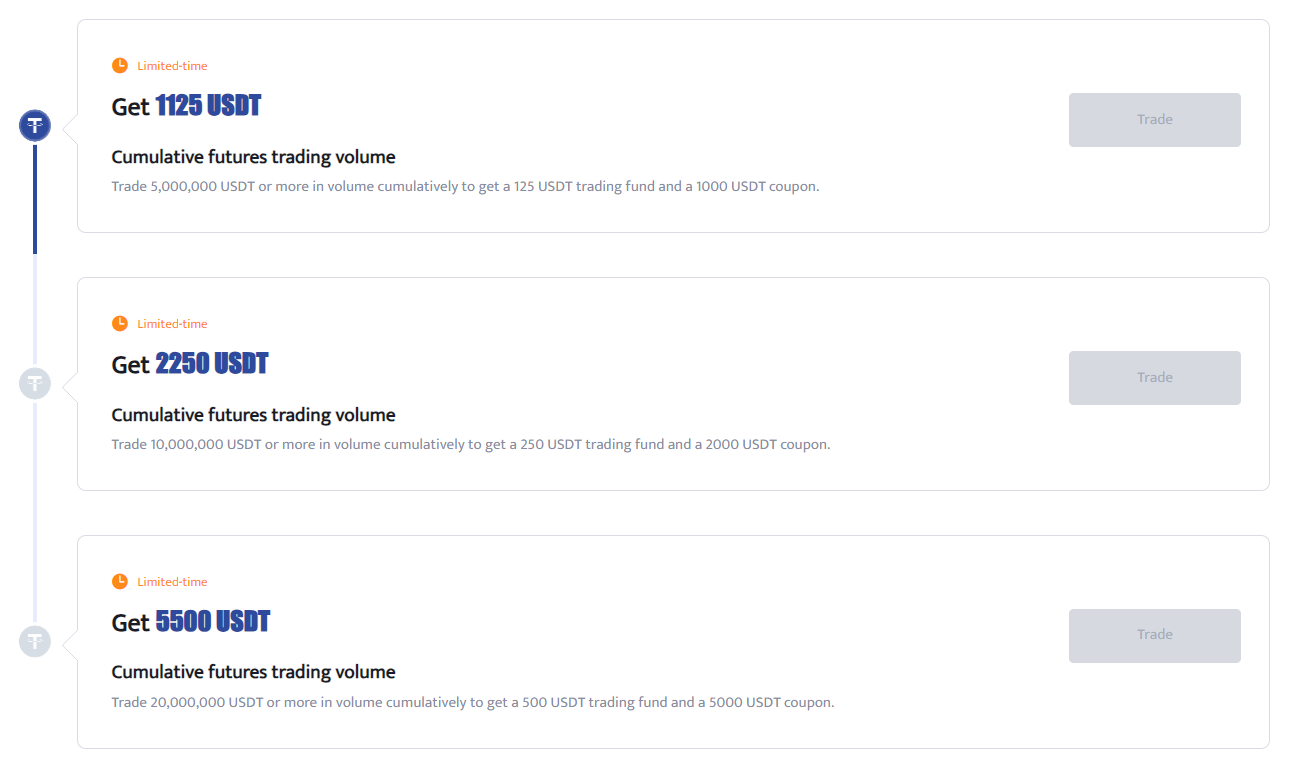

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*