Recommended

What is Leverage Trading in Crypto? How Can I Trade at 100X Leverage?

2024/04/16By:

Leverage is the act of initiating a trading position with borrowed capital, thereby potentially magnifying the associated losses or profits. By utilizing leverage, a trader is able to exert greater influence over a greater portion of an asset than if they were utilizing their own capital alone. The hazards are also amplified in tandem with the returns, as losses are magnified.

Traditional financial markets (TradFi) employ leverage in addition to cryptocurrencies, commodities, equities, bonds, and real estate.

What is Crypto Leverage Trading?

Margin is a fraction of the amount a trader requires as security to start a more prominent position. When trading, you can double the amount of positions called leverage. Thus, if a margin trader uses 100 times the leverage, their risk and possible profit can be increased by 100 times.

Leverage is a powerful tool for traders. You can use it to benefit from relatively small price fluctuations, provide larger position sizes for your portfolio, and grow your capital more quickly.

Leveraged trading is like margin trading.Margin is a small fraction of the amount a trader needs as security to start a more prominent position. When the transaction is in progress, if a trader uses 100 times the leverage, their risk and possible profit can be increased 100 times.

Different Bitcoin exchanges offer different levels of leverage. While some Bitcoin exchanges offer 200x leverage, enabling traders to create positions worth 200x their original deposit, other Bitcoin exchanges only provide 20x, 50x, or 100x leverage. A trade with 100:1x is called a 100x leverage trade.

Look more:Best High Leverage Crypto Trading Exchange Platform

| Download App for Android | Download App for iOS |

How does Leverage Trading Work in Crypto

You must deposit funds into your trading account, which is referred to as collateral, before you may comprehend leverage in cryptocurrency trading. The collateral needed to establish a position differs according to the leverage you select and the total value you desire to open.

Crypto Leverage Trading Example

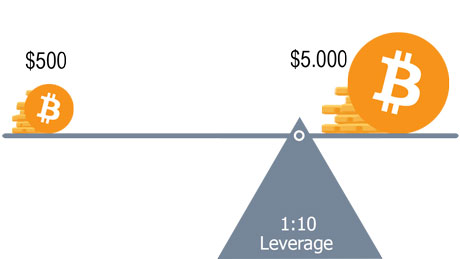

Assuming you have chosen to invest $5,000 in Bitcoin using a 1:10 leverage ratio, the necessary margin in this scenario would be 1/10 of the $5000, or $500, which would serve as collateral for the loan. The needed margin decreases with increasing leverage; for example, with 1:40 leverage and a $5,000 stake, the margin would be $5000/40, or $125.

This was the best part. However, there is a catch: if you decide to go long but the market moves against you and your margin falls below the maintenance threshold (also known as the maintenance margin), your funds will be liquidated unless you add more funds to your account. This means that the higher the leverage, the higher the risks of getting liquidated.

It goes without saying that leverage can be used for both long and short positions. In case you didn’t know, initiating a long position indicates your expectation that an asset’s price will rise, and initiating a short position indicates the opposite expectation.

Look more:Best Crypto Exchange to Trade with Leverage

| Download App for Android | Download App for iOS |

Benefits of Using Leverage

- Expanded profits. You only need to invest a fraction of the value of the trade to make the same profit as any other regular trade on the exchange.

- Take advantage of opportunities. Using leverage frees up capital that can be used for other investments. The ability to increase the amount available for investment is called leverage.

- Profiting from market declines. Using leveraged products to speculate on market movements allows you to benefit from both down and up markets.

Look more:How do contracts trade on BTCC? BTCC Account Guide.

Risks of Using Leverage

Margin trading was, until recently, much more common in currency markets, as it was generally considered too risky to be used in highly volatile cryptocurrency markets.

Unlike regular trading, you can lose your entire initial investment margin trading. Further, the more you leverage, the quicker you can lose it. For example, if I go long on a 3:1 margin. Margin trading is a type of leveraged trading. It’s means that I can deposit $100 into a margin account and get three times my buying power trading balance.

It’s also means that if I trade three times my balance ($300) and my position becomes -$100, I will lose everything I hold as collateral. I have made more money in a short period through margin trading than I have ever made in my entire life. And more money is lost than ever before.

Leverage increases risk and cryptocurrencies are more volatile than stocks and other traditional markets. However, recognizing the potential risk, the vvolatility of cryptocurrencies creates profits for traders, and in a shorter period, only a part of the investment can produce significantly high profits.

| Download App for Android | Download App for iOS |

Different Types of Leverage Trading

Leverage trading has been introduced into cryptocurrency markets in a few key ways. Here’s a quick rundown of how each operates:

Crypto Futures

Without having to own the underlying commodity, traders can take long or short positions on cryptocurrencies using crypto futures contracts. In a manner similar to the last example, traders can achieve leverage by opening positions valued at a multiple of the collateral capital they deposit as margin. Daily price variations lead to the “marking to market” process, which settles profits or losses to accounts on a daily basis. As previously mentioned, trading futures carries a risk of forced liquidations.

Margin Trading

Through margin trading, cryptocurrency traders can open leveraged spot positions by borrowing money from their cryptocurrency exchange. Traders can open positions priced at a multiple of the collateral capital they deposit as margin. Keep in mind that exchanges set maintenance margin thresholds and restrictions that, if not met, could result in forced liquidations. When positions are closed out, gains or losses are realized.

Crypto Options

The buyer of an options contract has the option, but not the duty, to purchase or sell the underlying cryptocurrency asset on or before the expiration date at a predetermined “strike” price. If the buyer exercises an option, the seller/writer assumes the responsibility to fulfill the option. Because of the comparatively little upfront premium paid in relation to the magnitude of the position established, leverage is achieved.

Where to Trade Futures at 100X Leverage?

To trade crypto futures at 100x leverage, you can choose BTCC crypto exchange. BTCC was founded in June 2011 with the goal of making crypto trading reliable and accessible to everyone.

We specializes in crypto futures contract trading, offering perpetual futures contracts. The maximum leverage offered by BTCC for daily futures contracts is 150x. The vast variety of futures offered by BTCC accommodates the trading habits and objectives of both novice and seasoned traders.We offer the USDT-margined futures and Coin-margined futures . Users can trade futures using USDT or cryptos like BTC, BTC, and XRP. And Large orders of up to 300 BTC can be executed at the top price levels.

Here are the main advantages of using the BTCC crypto exchange to trade futures:

- Largest variety of futures: Daily, Weekly, Quarterly and Perpetual futures

- Flexible leverage from 10x to 150x

- Lowest trading fees 0.03%

- Industry-leadingmarket liquidity

- Plenty of campaigns to win exciting rewards

Deposit and Receive Up to 10,055 USDT!

Trade on BTCC Now

| Download App for Android | Download App for iOS |

Conclusion

With leverage, you may easily start with less capital while yet having the chance for bigger returns. The combination of leverage and market volatility, however, might cause a rapid liquidation, particularly when trading with a leverage of 1:100. Before using leverage, be sure you’re trading safely and assessing the risk involved.

You should never use leverage or trade with money you cannot afford to lose.

Once you understand how to control it, leverage becomes a tool you can confidently use. If you like to take a hands-off approach to trading, leverage may not be the best choice for you. Otherwise, with the right management, leverage may be a powerful tool for success. Leverage, like any sharp instrument, requires caution when used improperly; nevertheless, this becomes irrelevant once mastery is achieved.

Since high-leverage trades can swiftly deplete your trading account if they go wrong, owing to big losses incurred by large-lot sizes, trading with lower-leverage allows you more breathing room by establishing a broader but reasonable stop and avoiding a bigger capital loss. Remember that the leverage can be adjusted to fit the requirements of any trader.

How to Trade Crypto Futures on BTCC?

To trade with BTCC, please follow these general steps:

Register an account: Visit the BTCC website and create an account. Provide the requested information, complete the verification procedure, and implement any necessary security measures, such as two-factor authentication (2FA).

Deposit Funds: After you’ve created your BTCC account, you’ll need to fund it. BTCC may accept numerous deposit methods, including bank transfers, cryptocurrency deposits, and other payment choices. Select the way that works best for you and follow the instructions to deposit funds into your account.

Choose a Trading Pair: BTCC offers a variety of cryptocurrency trading pairings. Choose which trading pair you want to trade. For example, if you wish to exchange Bitcoin for Ethereum, use the BTC/ETH trading pair.

Place an Order: BTCC normally offers choices for market and limit orders. A market order allows you to buy or sell cryptocurrencies at the current market price. With a limit order, you specify the price at which you wish to purchase or sell, and the trade is executed when the market hits that price.

Monitor and Manage Trades: After placing your order, you can track the status of your trade using the BTCC interface. You may see open orders, filled orders, and your trading history. You can also use stop-loss or take-profit orders to limit your risk or automate specific components of your trading plan.

Withdraw Funds: If you want to take your funds off the exchange, you can do so by withdrawing them from your BTCC account. To initiate a withdrawal, follow the instructions provided and provide the relevant information, such as the destination wallet address.

Stay Informed: Keep track of market movements, news, and other variables that may affect cryptocurrency values. BTCC may offer real-time market data, trading charts, and analysis tools to assist you make informed trading decisions. Staying educated can help you optimize your trading tactics.

Look more:

How to Trade Crypto Futures Contracts on BTCC

How to Buy and Deposit Crypto on BTCC?

BTCC Starter Rewards!

Deposit and Receive Up to 10,055 USDT!

| Download App for Android | Download App for iOS |

About BTCC

BTCC is one of the world’s oldest and most popular bitcoin exchanges. Bobby Lee created it in 2011, with its headquarters initially located in Shanghai, China. BTCC contributed significantly to the early development of the Bitcoin and cryptocurrency ecosystems.

BTCC initially concentrated on Bitcoin trading, but it gradually expanded its capabilities to cover other cryptocurrencies as well. The exchange allows users to purchase, sell, and trade numerous cryptocurrencies, including as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), among others.

BTCC has received recognition for its strong trading platform, liquidity, and security precautions. The exchange provides features such as spot trading, margin trading, and futures trading to accommodate various types of traders and investors. It gives consumers real-time access to market data, order books, and trading charts, allowing them to make informed trading decisions.

BTCC has undergone various alterations throughout the years in order to adapt to the changing regulatory landscape. It expanded its activities abroad, opening offices in other countries to serve a global customer base. However, cryptocurrency legislation and availability may differ based on jurisdiction.

As the cryptocurrency market evolves, BTCC remains a significant player in the industry, providing a variety of services and contributing to the growth and development of the crypto ecosystem.

BTCC Pros

- Established Reputation: BTCC is one of the oldest and most well-known cryptocurrency exchanges, having been operational since 2011. Its history in the market enhances its credibility and trustworthiness.

- A Diverse Selection of Cryptocurrencies: BTCC allows customers to access and exchange a wide range of digital assets.

- Margin and Futures Trading: BTCC provides margin and futures trading options, allowing customers to expand their trading holdings and potentially increase their profits.

- Proficient Trading Instruments: such as real-time market data, trading charts, and technical analysis indicators. These tools can help users make informed trading decisions.

- Security Measures: BTCC values security and uses a variety of safeguards to secure customer payments and information. This includes two-factor authentication (2FA) and cold storage of cryptocurrency assets.

| Download App for Android | Download App for iOS |

BTCC Bonus

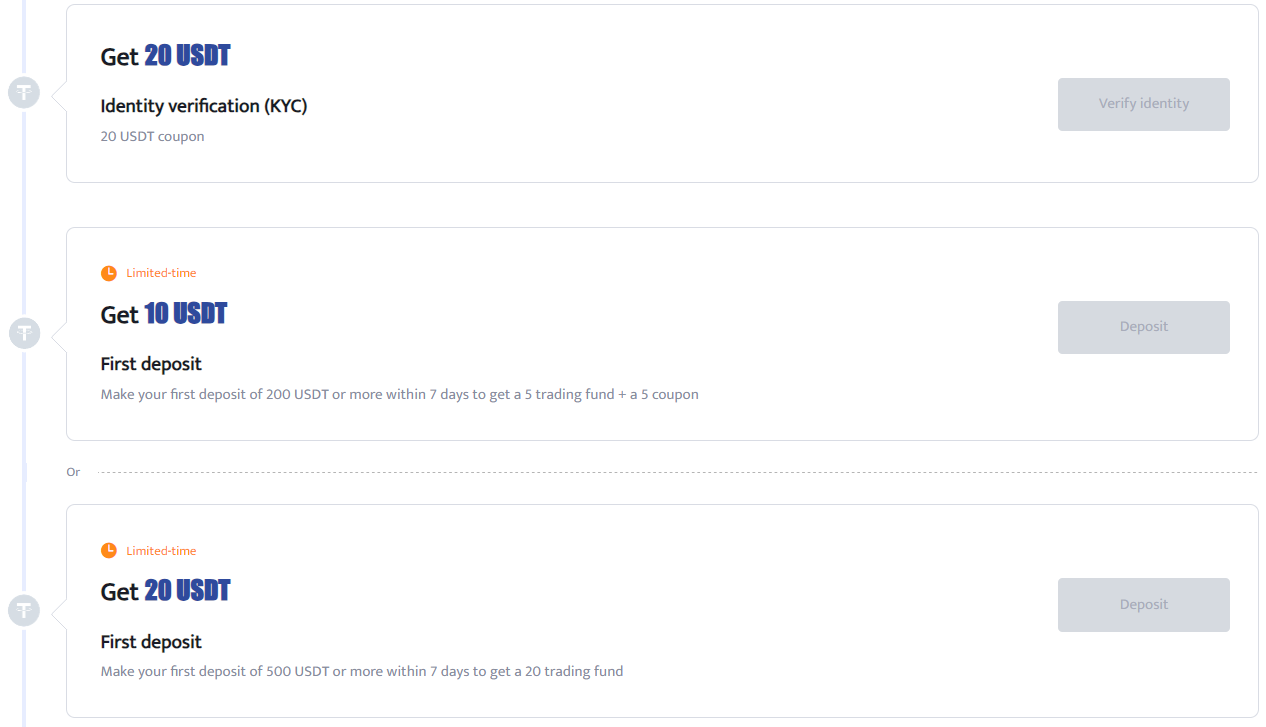

BTCC bonuses apply to different categories of users. You can deposit and receive up to 10,055 USDT. Every new user gets a 10 USDT coupon after completing their registration. You will also get an additional 20 USDT coupon on completing your KYC verification.

- Bonus On First Deposit And Trade

You will get a bonus worth 10 USDT when you deposit 200 USDT and above within 7 days of opening an account. The reward includes a 5 trading fund and a 5 USDT coupon.

If the deposit is 500 USDT and above, you will get a 20-trading fund. Furthermore, if you make a cumulative deposit of 2000 USDT within 30 days of opening an account, you will get a 30 USDT trading fund. Trading within 7 days of signing up will also earn you a 20 USDT coupon.

- BTCC Futures Trading Bonus

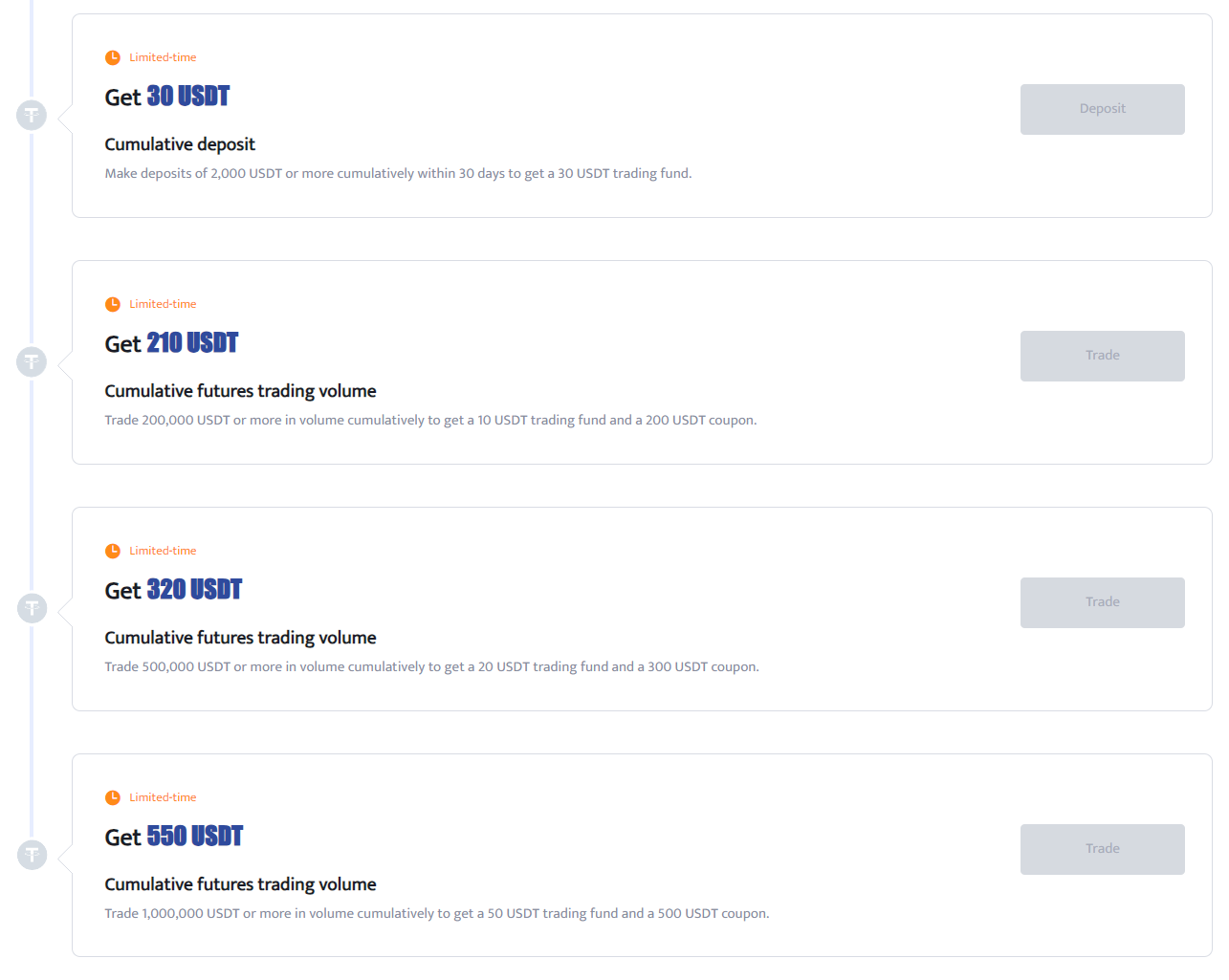

You can earn bonuses from trading futures on BTCC within a stipulated time.

- A cumulative future trade of 200,000 USDT and above will earn you a 10 USDT trading fund and a 200 USDT coupon.

- A cumulative future trade of 500,000 USDT and above will earn you a 20 USDT trading fund and a 300 USDT coupon.

- A cumulative future trade of 1 million and above will earn you a 50 USDT trading fund and a 500 USDT coupon.

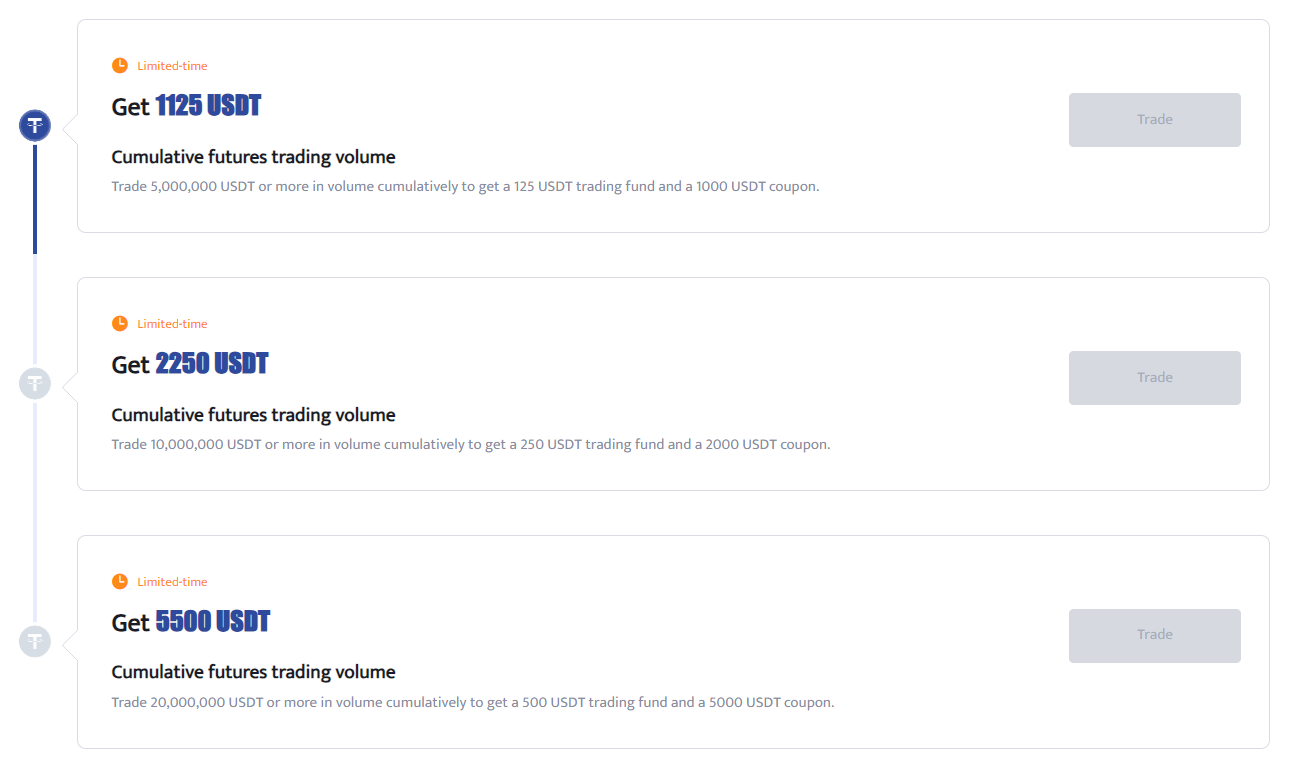

- A cumulative future trade of 5 million USDT and above will earn you a 125 USDT trading fund and a 1000 USDT coupon.

- A cumulative future trade of 10 million USDT and above will earn you a 250 USDT trading fund and a 2000 USDT coupon.

- A cumulative future trade of 20 million USDT and above will earn you a 500 USDT trading fund and a 5000 USDT coupon.

- Other Bonus

Invite a friend to BTCC to get a 25% rebate on their trading fees. You can get up to 530 USDT in rewards per referral.

Related Posts:

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

Best Crypto Exchange to Trade with Leverage

Best High Leverage Crypto Trading Exchange Platform

Here is a Cryptocurrency Scammer List of 2022

Free Crypto No Deposit Bonus For Signing Up 2022

Terra Classic Price Prediction- Will LUNC Hit $1?

Binance Learn and Earn Quiz Answers – LDO, WOO, QI Quiz Answers

Terra Classic Burn: The Reason Behind LUNC and LUNA Recent Spike

Apecoin Price Prediction 2022, 2025, 2030 – Will Apecoin Go Up?

Ripple (XRP) Price Prediction 2023, 2025, 2030 : Why Are XRP Prices So Low?

Solana (SOL) Price Prediction 2022,2050, 2030-Future of Solana?

Avalanche (AVAX) Price Prediction 2022,2025,2030 – Is AVAX a Good Investment?

Chainlink (LINK) Price Prediction 2023, 2025, 2030 – Is LINK a Good Investment?

Dogecoin (DOGE) Price Prediction 2023, 2025, 2030 – Will DOGE Explode in 2023?

Bitcoin (BTC) Price Prediction 2023, 2025, 2030 – Is BTC a Good Investment?

Litecoin Price Prediction 2023, 2025, 2030: Is Litecoin a Good Investment?

Dash Price Prediction 2023, 2025, 2030: Is DASH a Good Investment?

GMT Price Prediction 2023, 2025, 2030: Is GMT Coin a Good Investment?

Bitcoin Cash Price Prediction 2023, 2025 and 2030: Is Bitcoin Cash a Good Buy?

Yearn.Finance (YFI) Price Prediction 2023, 2025, 2030 – Is YFI a Good Investment

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Tron (Uniswap (UNI)) Price Prediction 2023, 2025, 2030 — Will Tron Hit $1?

Gala (GALA) Price Prediction 2023, 2025, 2030 — Is GALA a Good Investment?

Blur Price Prediction 2023, 2025, 2030: Is Blur Crypto a Good Investment?

Fantom (FTM) Price Prediction 2023, 2025, 2030—Is FTM a Good Investment?

Polkadot (DOT) Price Prediction 2025 – 2030: Is Polkadot a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Bitcoin SV Price Prediction 2023, 2025, 2030: Is Bitcoin SV a Good Investment?

Aptos (APT) Price Prediction 2023, 2025, 2030- Will APT Go Up?

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download

- Terms & Agreement

- Customer Service

Quick Links

Risk warning: Digital asset trading is an emerging industry with bright prospects, but it also comes with huge risks as it is a new market. The risk is especially high in leveraged trading since leverage magnifies profits and amplifies risks at the same time. Please make sure you have a thorough understanding of the industry, the leveraged trading models, and the rules of trading before opening a position. Additionally, we strongly recommend that you identify your risk tolerance and only accept the risks you are willing to take. All trading involves risks, so you must be cautious when entering the market.

The world’s longest-running cryptocurrency exchange since 2011 © 2011-2024 BTCC.com. All rights reserved

Comments

Leave a comment

Your email address will not be published. Required fields are marked with an asterisk (*).

Comment*

Name*

Email address*